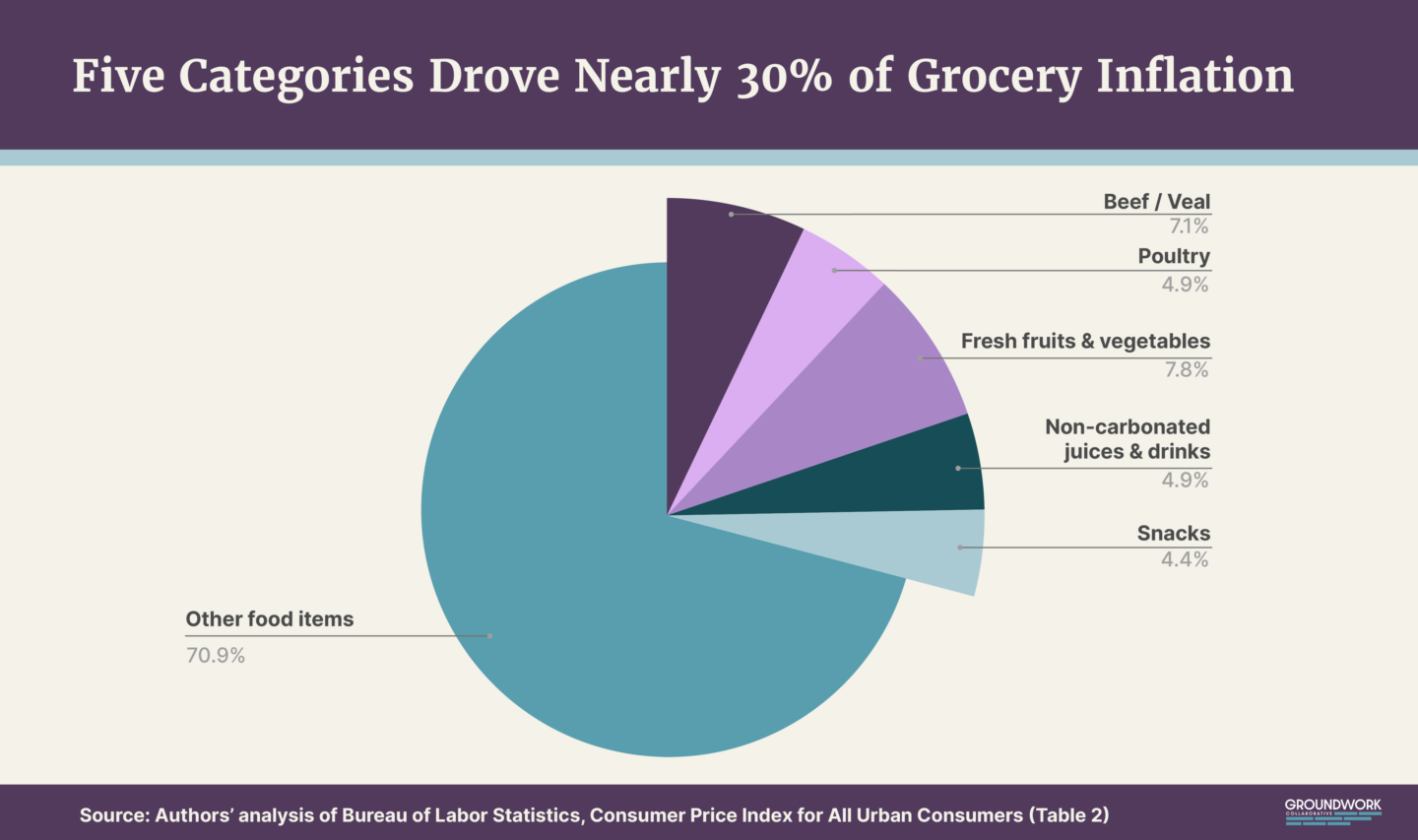

A deeper look at these five categories reveals a host of causes for rapid price increases, from climate-related supply shocks to supply chain disruptions to expanding corporate profit margins. Addressing these underlying issues may not drive down prices in the short term, but can reduce the risks of future price spikes and create a more resilient, consumer-friendly food system.

Supply Shocks

Both domestically and internationally, a number of recent acute shocks have reduced the supply of key inputs, helping drive up the price of certain grocery items.

Meat

Since 2020, the number of cows raised for beef consumption has decreased – just last year, farmers raised the lowest number of beef cows since 1971. Drought conditions over the past few years have significantly limited pasture for grazing and sustaining cows.

In addition, one of the main drivers of poultry prices going up has been the recent outbreak of avian flu, a form of influenza that primarily targets bird species. Avian flu has long been detected throughout the world, but in 2022, the U.S. experienced the worst avian flu outbreak in history, affecting over 80 million chickens, turkeys, and other birds, and severely reducing the supply of poultry.

Juice

Over the past two years, there have been significant supply shocks to ingredients in juice and other non-carbonated beverages. Domestic orange production was down 12 percent last year. Florida is one of the main domestic producers of citrus, and the state has been disrupted by numerous supply shocks. In 2022, Hurricane Ian destroyed over $400 million worth of citrus plants and infrastructure in the state, causing the lowest citrus production since the Great Depression. In addition to climate-related shocks, the incurable citrus greening disease, which kills citrus plants, has also reduced the supply of citrus in places like Mexico, Brazil, and Florida.

Beyond citrus fruits, sugar supply shocks have driven up beverage prices. Global sugar prices hit a decade-high in fall of 2023, largely due to drought conditions caused by El Niño, the extreme climate conditions brought on by higher Pacific Ocean water temperatures. While global sugar prices increased by nearly 70 percent between January 2021 and their peak in fall 2023, U.S. sugar prices also increased by more than 50 percent over the same period. Severe drought in Mexico has decreased sugar imports to the U.S. and increased our sugar exports to Mexico. Further, droughts in Louisiana and Texas have reduced the domestic sugar supply.

Fresh Produce

Climate-related issues and disease outbreaks have also negatively affected fruit and vegetable production. As mentioned above, citrus greening disease is reducing citrus supply around the world. In addition, drought conditions have reduced domestic production. California produces over a third of the domestic supply of vegetables and nearly 75 percent of fruits, including strawberries, grapes, lettuce, tomatoes, carrots, blueberries, broccoli, and spinach. During the early months of 2023, the state faced an unprecedented amount of rain and flooding, which reduced the supply of fruits and vegetables.

Upstream Commodity Prices

Key inputs for many grocery staples have faced outsized price growth over the past few years, resulting in higher sticker prices.

Wheat

The war in Ukraine has played a significant role in rising wheat prices. Prior to Putin’s invasion, Ukraine was the fifth largest exporter of wheat, contributing nearly 10 percent of global exports. Global wheat prices immediately rose with the onset of the escalation, reaching historic highs in May 2022. Beyond the initial escalation in February 2022, Russia has continued to restrict and attack Ukrainian export ports, keeping global wheat markets fragile.

While forecasters anticipated severe and sustained supply shocks, Russia and Ukraine have been able to export more than expected. Russia is forecasted to export record levels of wheat this year, while Ukraine is exporting approximately 75 percent of pre-war levels. Wheat prices are significantly affected by speculation, driving prices up for consumers and driving down profits for farmers to make a quick buck for Wall Street traders.

Sugar

Beyond recent supply shocks, U.S. raw sugar prices are typically about two times more than world raw sugar prices. The U.S. sugar program subsidizes domestic sugar producers – making sugar farms substantially (between 24 and 54 percent) more profitable than other U.S. farms. The program allows sugar farmers to access low-rate loans from USDA, where sugar serves as collateral for the loans. USDA establishes the price per pound farmers will be paid for forfeited sugar, which effectively serves as a price floor for domestic sugar prices. For example, if USDA says they will pay 25 cents per pound of refined sugar, U.S. sugar refiners won’t sell their sugar to food production companies for less than 25 cents. The Government Accountability Office estimates that the U.S. sugar program drives up domestic sugar prices and provides U.S. sugar farmers with approximately $2 billion in benefits each year.

Beyond “price guarantees,” U.S. trade agreements limit sugar imports, allowing domestic producers and processors to charge higher prices for both raw and refined sugar. As a result of recent North American sugar supply issues, high-tariff sugar imports have increased, driving up sugar prices for domestic manufacturers that use sugar in other goods, like juice and snacks.

Oil

Vegetable oil prices have soared over the past two years. They are up 50 percent since 2019 (though down 33 percent since peaking in 2022). Several factors contribute to these high price increases. First, Indonesia, the world’s biggest producer of palm oil, temporarily banned palm oil exports in April 2022 in an effort to bring down rising domestic food prices. Since lifting the ban after three weeks, they have continued to restrict exports. Further, soybean oil supply has been affected by droughts in Argentina and Brazil, two of the top global exporters, causing yields to hit a near-50-year low. Argentina has increased export taxes and has restricted exports since the escalation of the war in Ukraine.

Additionally, the global sunflower oil supply has dwindled as a result of the Ukraine war; Ukraine and Russia accounted for 75 percent of supply, which has been severely reduced because of the destruction of storage facilities, export blockades, and sanctions. Finally, Canada, the largest producer of canola oil, saw a 35 percent drop in yields due to drought conditions. This has created ripple effects, causing Canadian farmers to plant far fewer canola crops in favor of higher-margin wheat, thereby creating long-term supply shortages.

While vegetable oils are generally highly interchangeable, nutritional values often vary, requiring manufacturers to update packaging. During the height of supply chain snarls, this meant weeks, if not months, of lead time, forcing manufacturers to stick to their original formulas and pay higher prices for input oils.

Cocoa

Global cocoa supply has declined by one-third as the climate crisis ravages Ivory Coast and Ghana, the world’s largest cocoa producers, which produce 60 percent of global supply. As a result, cocoa futures have doubled since January 2023. Excess rain is rotting cocoa trees, reducing and delaying harvests, and Wall Street speculators have driven prices up even further. Due to market regulations, cocoa prices are set at least a year in advance, meaning farmers are feeling the squeeze without actually feeling the windfalls trickle down. Large corporations are in a standoff with regulators, trying to negotiate lower prices, even as they raise prices for consumers and claim higher input costs.

Fertilizer

Global fertilizer prices hit near-record levels in 2022 and remain elevated, in part due to Russia’s war on Ukraine. Fertilizer accounts for nearly one-fifth of U.S. farm costs. Russia and Belarus are large global fertilizer suppliers, and export controls and international sanctions in the wake of Putin’s war have affected the global market. Further, energy price increases have affected fertilizer supply. In Europe, for example, natural gas prices reduced ammonia production, and in China, coal price increases and electricity rationing reduced fertilizer production plants’ output. Reliance on Russia and China for fertilizer nutrients poses long-term risks to the resilience of fertilizer supply chains.

Corporate Profiteering

Although supply chain issues and increased production costs have played a role in rising grocery prices, certain manufacturing and retail corporations have also taken advantage of the recent global inflation surge to raise their profit margins. These trends are most notable in more concentrated industries.

Meat Processing

The meat processing industry in the United States is highly concentrated, with four companies controlling between 55 percent and 85 percent of the market for beef, poultry, and pork processing. In 2021 and 2022, the industry saw wholesale prices grow much more rapidly than input prices. For example, the meatpacker Tyson Foods achieved record margins. In a 2021 earnings call, Tyson noted that its pricing actions “more than offset the higher COGS [cost of goods sold].”

Beverages

Though input costs have gone up for beverage producers, top companies in the beverage industry hiked prices beyond the increase of their input costs to expand their profit margins. Both PepsiCo, the parent company of Tropicana and Gatorade, and Coca-Cola, the parent company of Minute Maid and Simply – which together control nearly 30 percent of the juice industry – were able to expand their profit margins in the third quarter of 2023 by raising their prices by roughly 10 percent each. PepsiCo’s margins grew by 12 percent in the third quarter of 2023, even as the company noted that cost pressures induced by the Russia-Ukraine war had eased. Keurig Dr Pepper, the parent company of Mott’s and Snapple, nearly doubled its operating margin for its U.S. non-coffee beverage segment in the third quarter of 2023 (30 percent) compared to the same quarter in 2022 (15 percent).

Snacks

The CFO of Hershey, maker of Dot’s Pretzels, Skinny Pop, and Pirate’s Booty, said in the company’s 2023 third quarter earnings call that “pricing and productivity gains more than offset inflation and higher manufacturing and overhead costs.” As a result, its profit margins increased by 19 percent from the same quarter in the previous year. Between the third quarters of 2022 and 2023, PepsiCo, parent company of Frito-Lay, increased profit margins by 12 percent, primarily driven by increased prices. In the second quarter of 2023, Mondelez International, maker of Oreos, Wheat Thins, and Ritz Crackers, increased its operating income by $1.15 billion from higher pricing, where higher input costs reduced operating income by just $750 million. Its profit margins increased by 75 percent between the third quarters of 2022 and 2023.

Policy Considerations to Combat the Grocery Affordability Crisis

While the Biden administration has taken several steps to address the root causes of some recent grocery price increases, there are additional measures the administration and Congress could pursue to reduce the risk of future grocery price spikes and limit the financial harm to vulnerable families.

The Biden administration has taken a number of steps to bring down grocery prices and help American consumers.

In addition to its historic expansion of SNAP to provide more financial security to more than 40 million Americans, the Biden administration has also sought to address some of the underlying causes of recent grocery price increases:

- Identifying and addressing anticompetitive and anti-consumer structures and practices in food, retail, meat/poultry, and other agricultural industries by partnering with state Attorneys General, especially to crack down on price gouging, and taking price-fixing agricultural corporations to court.

- Investing in increasing competition and resilience in the meat and poultry supply chains by providing $1.2 billion in grants and loans to combat corporate consolidation and outsized pricing power that squeezes farmers, ranchers, and consumers.

- Leveling the playing field in the chicken industry by requiring transparency from the large corporations that have exploited, deceived, and pushed chicken farmers into debt.

- Investing in domestic food supply chains by diversifying food processing, creating more resilient agricultural markets, and increasing competition in fertilizer production, providing nearly $200 million to 185 projects that create economic opportunity for farmers and rural Americans, and using the power of the federal purse to ensure domestic producers reap the benefits of USDA nutrition assistance programs.

- Making historic investments in combating climate change through the Inflation Reduction Act (IRA). The IRA invests over $200 million in expanding the food and agricultural workforce and supports local farmers and ranchers who face financial hardship from predatory lending. Beyond these direct effects in the agricultural industry, the IRA will significantly reduce emissions and slow the pace of climate change, which will make food supply chains more resilient and less likely to experience significant shocks.

Recommendations for further action

We propose additional actions policymakers should pursue to reduce the risk of future grocery price spikes.

Investigating and potentially reforming the use of slotting fees

As the Biden administration looks to crack down on anti-consumer practices, one area worthy of additional scrutiny is slotting fees. Because retail stores have limited shelf and storage space, they often require manufacturers to “pay to stay” on the shelves. This storage problem is especially true in grocery stores, where many items are perishable or require specific storage (e.g., certain temperatures or types of shelving). The freezer aisle can only hold so many pints of ice cream and the chips aisle can fit only so many bags of chips.

Complicating this further, large grocery retailers have private-label brands (e.g., Wal-Mart’s Great Value, Kroger’s Private Selection, Safeway’s Signature Family), where vertical integration increases margins for retailers. While these name-brand alternatives often save consumers money, they give retailers greater power over pricing and product availability.

Grocers’ control over shelf space allows them to maximize the availability of high-margin products (like private labels) and auction off the rest to willing bidders. This raises prices because companies pass on slotting fees to consumers. It also makes it harder for smaller companies to compete, even if they can potentially offer products that are less expensive than their larger competitors.

The Federal Trade Commission (FTC) explored issuing guidelines for slotting fees in 2000, but ultimately never completed them. The FTC can use its section 6(b) authority to get specific information about how slotting fees are used and their potentially anticompetitive effects. If slotting fees are preventing market access for lower-price competitors or increasing market power for retailers, the FTC should reform slotting allowances.

Carefully scrutinizing anticompetitive mergers throughout the food supply chain

Throughout the food and agriculture industry, from fertilizer to meatpacking, monopolies reduce competition and provide an easy route for corporations to hike prices. In October 2022, Kroger and Albertsons announced a $25 billion merger deal, which, if approved by regulators, would give the resulting mega-chain nearly 17 percent of market share. In some communities, this would result in a near monopoly. More recently, Aldi announced a deal last August to acquire 400 Winn-Dixie and Harveys Supermarket locations.

The FTC has been reviewing the proposed Kroger-Albertsons $25 billion merger deal for over a year but has yet to issue a decision.

While the companies argue that they would be able to lower prices, pay higher wages, and compete with retail giant Walmart, antitrust experts have pointed out that the merger would create a grocery monopoly in many markets. The FTC has found that grocery mergers have a high potential to increase grocery prices. Other research suggests that grocery workers stand to lose hundreds of millions of dollars and store closures could harm consumers’ food access if these anticompetitive mergers are permitted and the grocery industry is further consolidated.

While Kroger has agreed to divest certain stores, divestitures have been unsuccessful in previous grocery mergers. For example, as a condition of approving the deal, the FTC required that Albertsons sell off 170 stores when it merged with Safeway. Within months, Albertsons repurchased 33 of the divested stores after the buyer filed for bankruptcy.

The Kroger-Albertsons merger raises the risk of higher grocery prices in several communities. We urge the FTC to carefully review the merger and other pending deals that would pose similar risks.

Finalizing regulations to promote competition in meatpacking

In part due to a decline in federal antitrust enforcement, concentration in meatpacking has skyrocketed over the past 40 years. Between 1980 and 2020, the market share of the largest four beef packers rose from 36 percent to 81 percent; and between 1977 and 2020, the market share of the largest four poultry processors increased from 22 to 53 percent.

In January 2022, the Biden administration released a plan to improve fairness, competition, and resiliency in meat and poultry supply chains. Included in that action plan was a commitment to strengthen the Packers and Stockyards Act, the meat industry-specific antitrust law, which was severely weakened by the Trump administration.

In October 2022, USDA proposed regulations to prohibit discrimination, retaliation, and deceptive practices in livestock and meat processing markets that weaken competition and market integrity. These rules would significantly improve the industry for farmers, ranchers, and consumers. The Biden administration should finalize them expeditiously, and complete other rules it has publicly committed to issuing under its Packers and Stockyards authority.

Reinstating and making food assistance expansions permanent

At the onset of the COVID-19 pandemic, Congress enacted temporary SNAP Emergency Allotments as part of the families First Coronavirus Response Act. The law gave USDA the authority to increase households’ SNAP benefits to the maximum benefit for their household’s size. The Biden administration expanded this policy in 2021 to reach the 40 percent of households that already received the maximum benefit, giving all households a supplement of at least $95 per month. Emergency Allotments reduced poverty by 10 percent – and child poverty by 14 percent.

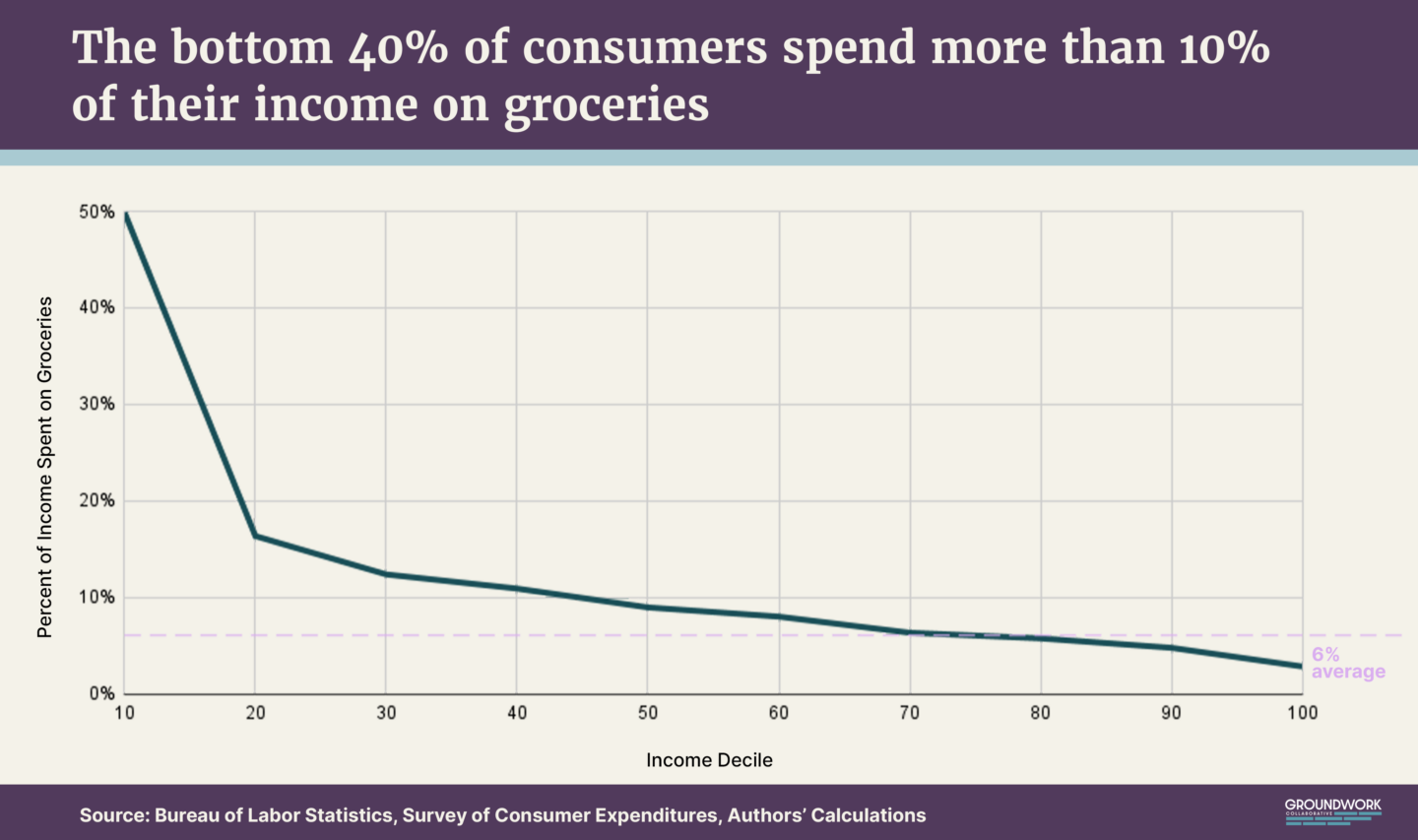

In March 2023, the Emergency Allotments lapsed as a result of Congress terminating the authority in the 2022 omnibus funding bill. Many families saw a decline in benefits. Benefits for households with children decreased, on average, $223 per month, while benefits for households with seniors decreased by an average of $168. Although cost-of-living adjustments and the Biden administration’s overhaul of the Thrifty Food Plan softened the cliff when Emergency Allotments ended, SNAP benefits still fall short of fully addressing food insecurity in the U.S.

Congress should expand SNAP to provide the benefits it was providing temporarily during the pandemic to ensure more families’ full food needs are met.