Inflation has come down significantly from its peak over the past year, yet prices remain high for American consumers. As supply chain snarls have receded and the economy has stabilized, businesses continue to pad their bottom lines, rather than passing these savings on to consumers.

By: Liz Pancotti, Strategic Advisor, and Lindsay Owens, Executive Director

As Their Cost of Doing Business Comes Down, Corporations Pad Their Bottom Lines on the Backs of Consumers

Inflation has come down significantly from its peak over the past year, yet prices remain high for American consumers. From housing and groceries to car insurance and electric bills, families are still feeling the squeeze. In the wake of the pandemic, virtually every company in every industry faced rising costs to make products and stock shelves. Labor costs rose sharply, the cost of transporting goods across the country hit record highs, and raw materials became costly or impossible to get. Corporations were quick to pass rising costs – and a little extra – on to consumers, fueling rapid inflation. As supply chain snarls have receded and the economy has stabilized, businesses continue to pad their bottom lines, rather than passing these savings on to consumers.

Download the full report here.

Some economists and pundits have sought to discredit the link between inflation and corporate profiteering. A Washington Post columnist recently claimed that blaming inflation on corporate profiteering is like saying, “it’s raining because water is falling from the sky.” But this isn’t true. Prices are simply the sum of costs and corporate profits. While rising costs of inputs can drive up what Americans pay at the gas pump or the grocery store, corporate profits can just as easily.

As corporations have lamented supply chain woes and higher labor costs over the past two years, their profits have skyrocketed, fueling inflation and exacerbating a longstanding affordability crisis.

Some economists suggested that markup growth in 2021 was primarily driven by corporations raising prices in anticipation of future cost increases. However, corporate profit margins have remained high – and even grown – as labor costs have stabilized, nonlabor input costs have come down, and supply chain snarls have eased.

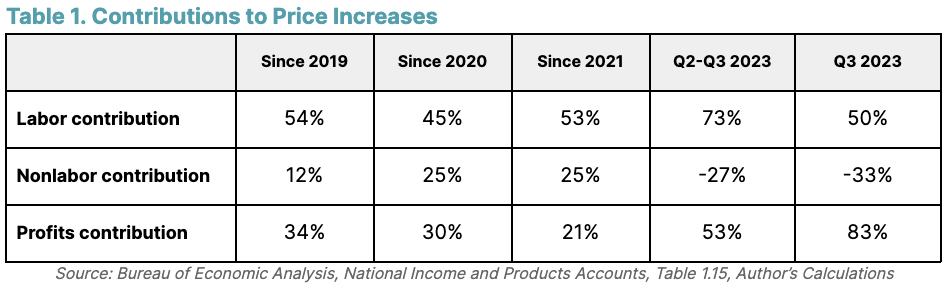

While labor and nonlabor input costs have played a role in price increases, corporate profits drove 53 percent of inflation during the second and third quarters of 2023 and more than one-third since the start of the pandemic. Comparatively, over the 40 years prior to the pandemic, they drove just 11 percent of price growth.

Source: Bureau of Economic Analysis, National Income and Products Accounts, Table 1.15, Author’s Calculations

Corporate profits as a share of national income has skyrocketed by 29 percent since the start of the pandemic. While our economy has returned to or surpassed its pre-pandemic levels on many indicators, workers’ share of corporate income has still not recovered.

Source: Bureau of Economic Analysis, National Income and Products Accounts Tables 1.14 and 6.16D, Author's Calculations

As White House National Economic Council Director Lael Brainard has noted, “Overall, the labor share of income has declined over the past two years and appears to be at or below pre-pandemic levels. While corporate profits as a share of GDP remain near postwar highs.”

Economist Isabella Weber has pointed out that corporations are keeping prices high even as post-pandemic and Ukraine War supply chain pressures ease and wage growth slows. Why? Because they can.

Weber argues that supply shocks allowed corporations to tacitly collude, hike prices, and rake in record profits. This type of inflation, where corporations raise prices to protect – and even increase – their profit margins, allows prices to rise faster than the costs to make goods or provide services. When corporations pursued this opportunistic pricing strategy, they found a lot of space to increase prices, drive up profits, and see very little dropoff in demand.

Though inflation has eased, prices remain tremendously elevated from their pre-pandemic levels. Housing costs, for example, are up 21 percent, and grocery costs have risen by 25 percent.

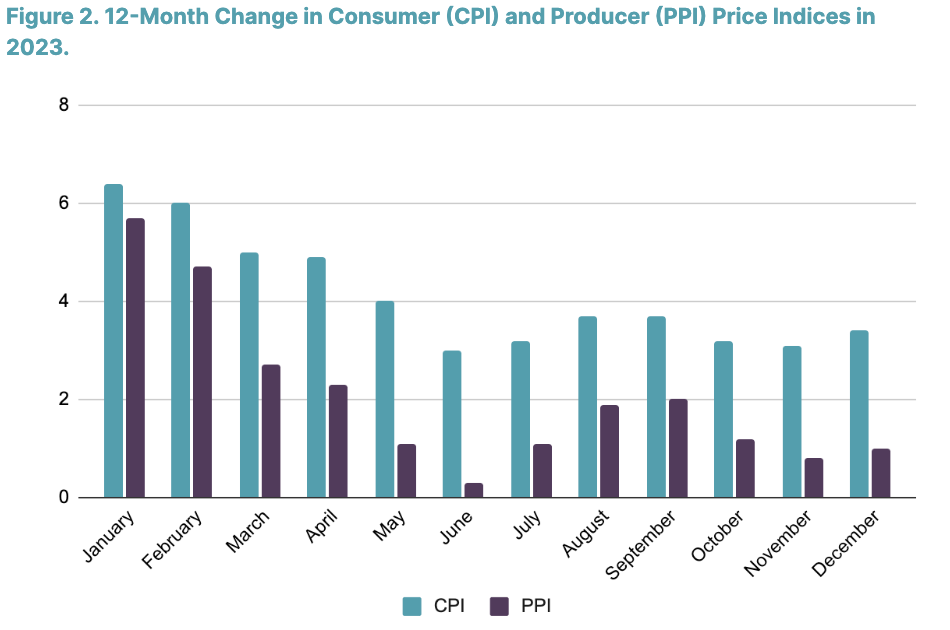

While prices for consumers have risen by 3.4 percent over the past year, input costs for producers have risen by just 1 percent. For many commodities and services, producers’ prices have actually decreased.

Source: Bureau of Labor Statistics, Consumer Price Index, Table 5; Producer Price Indexes, Table A

Input costs for key goods and services have sharply decreased over the past year. For example, nearly 60 percent of the drop in input goods prices was driven by large declines in energy costs, such as jet fuel and diesel fuel. Transportation and warehousing costs, which many corporations have cited as a main driver of price increases, have come down by nearly 4 percent since peaking in June 2022.

These input costs are critically important for corporations’ balance sheets. As costs go down but revenue stays high because of higher sticker prices, corporate profit margins expand on the backs of American consumers.

One prime example of this is the diaper industry, which is highly concentrated – Procter & Gamble Co. (P&G) and Kimberly-Clark Corp. control 70 percent of the domestic market. Diaper prices have increased by more than 30 percent since 2019 from, on average, $16.50 to nearly $22. Wood pulp is a major input in diapers and other paper products, like toilet paper and paper towels. Wholesale wood pulp prices soared by 87 percent between January 2021 and January 2023. Yet between January and December 2023, prices declined by 25 percent.

Using their pricing power, P&G and Kimberly-Clark have kept diaper prices high for American families, allowing their profit margins to expand considerably. In P&G’s October 2023 earnings call, its CFO, Andre Schulten, said that high prices were a big driver of profit margin expansion and 33 percent of their profits in the previous quarter were driven by lower input costs. During P&G’s July 2023 earnings call, the company predicted $800 million in windfall profits because of declining input costs. In Kimberly-Clark’s October 2023 earnings call, CEO Mike Hsu said the company “finally saw inflection in the cost environment” and admitted that he believes the company has “a lot of opportunity to [expand margins over time] between what [they’re] doing on the revenue side and also on the cost side.” Despite these large input cost declines, Hsu said he thinks the company has “priced appropriately” and did not anticipate any price deflation.

The diaper industry is just one example of corporations exploiting their pricing power to expand margins as input costs normalize. The same is true for many consumer goods, including new and used cars, groceries, and housing.

Over the past two years, corporations have been explicit about how they’ve exploited their pricing power, and how they have and will continue to do so even as inflation comes down.

In the wake of the pandemic, consumer demand rebounded and supply chains struggled to keep up as a result of decades of disinvestment and offshoring. Goods became more expensive to make and transport, and tighter labor markets delivered long-overdue wage increases for workers. As businesses’ costs went up, they jumped on the opportunity to pass on rising costs to consumers and have continued squeezing American’s pocketbooks for more. Now that their costs have stabilized – or, in many cases, come down significantly – it’s time for companies to stop gouging consumers.

The Biden administration is taking steps to strengthen global supply chains and onshore manufacturing, crack down on corporate concentration that has enabled corporations to put consumers through the wringer, and eliminate junk fees. President Biden said last month, “To any corporation that has not brought their prices back down — even as inflation has come down, even [as] supply chains have been rebuilt — it’s time to stop the price gouging.” The Consumer Financial Protection Bureau, the Federal Trade Commission, and the Department of Justice continue to dust off authorities not touched in decades to rein in corporate profiteering and concentration.

As Congress turns to expiring provisions from the 2017 Trump tax cuts over the next year, they must take a hard look at the corporate tax rate. Our tax code should support a robust and equitable economy, not incentivize profiteering.

The fundamental question we need to ask ourselves is whether we want an economy where corporations can exploit pandemics, supply chain crises, and wars at the expense of American workers and families, or an economy where corporations are put in check, allowing everyone to thrive?