High Prices, Uneven Economy, and a White House Looking for Shortcuts

High Prices, Uneven Economy, and a White House Looking for Shortcuts

Prices are still too high for American families. This week’s Consumer Price Index (CPI) report showed that prices increased 2.7% over the past year, still well above the Federal Reserve’s 2% target and likely artificially muted by the lingering effects of the government shutdown. The most painful price hikes are hitting essentials families can’t cut back on. Housing costs rose 3.2% and electricity prices jumped 6.7% in 2025, and American families paid $310 more on average for groceries during Trump’s first year in office compared to 2024 according to recent Joint Economic Committee analysis.

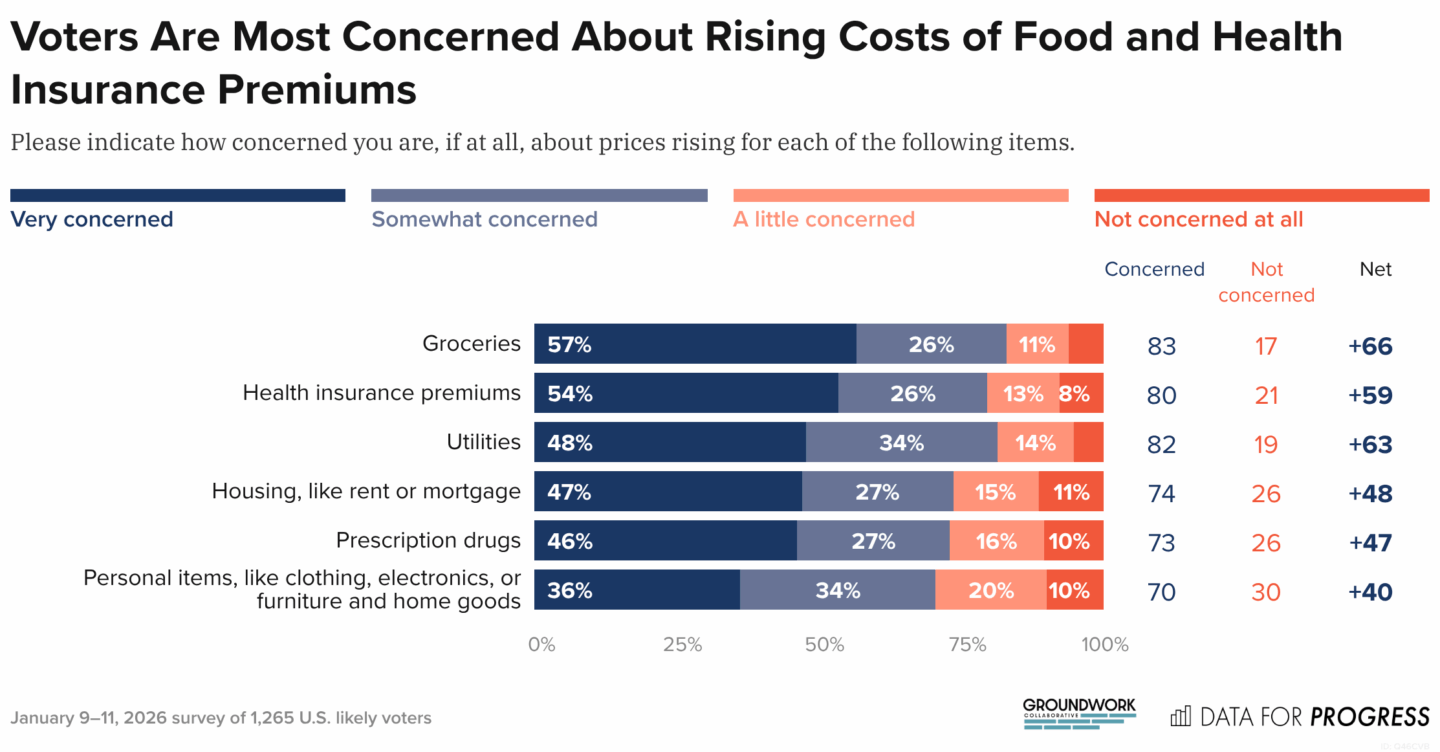

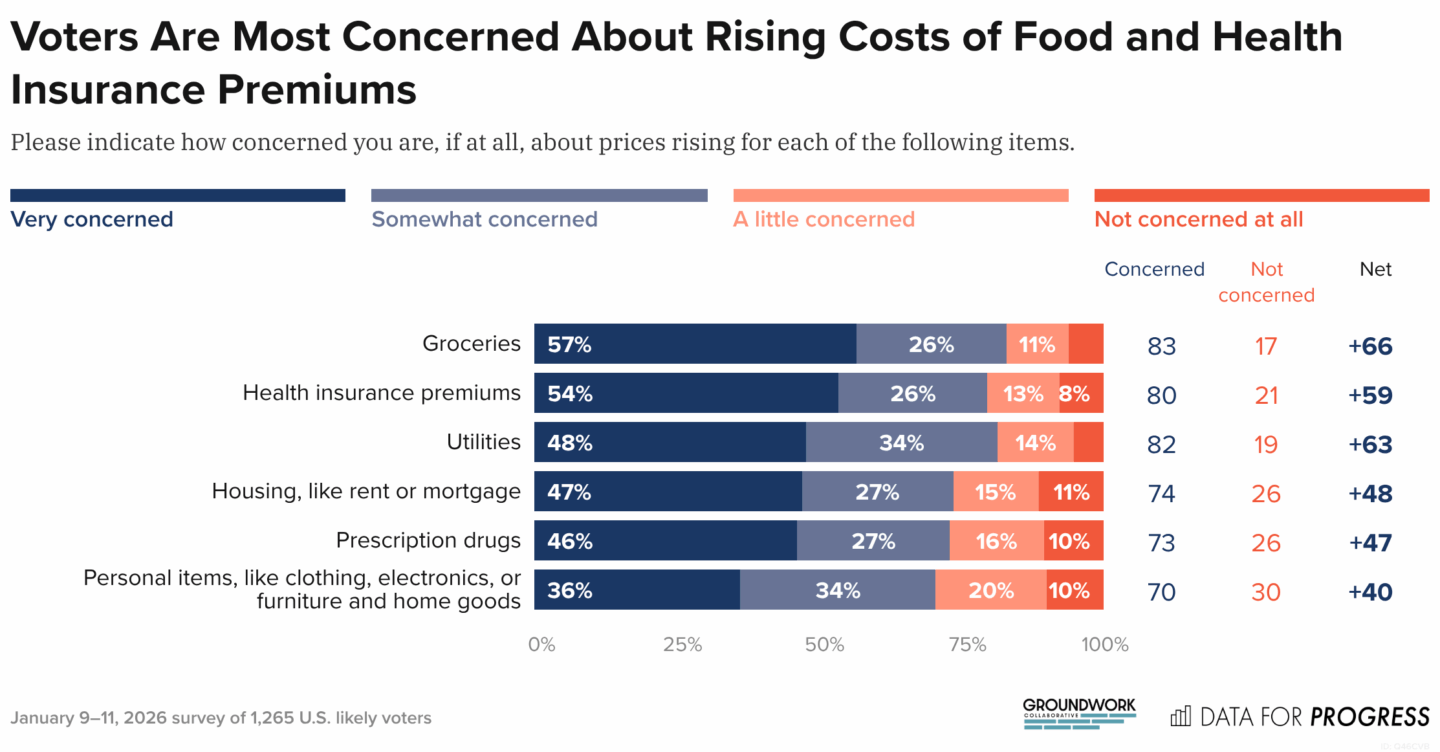

The Federal Reserve’s latest Beige Book sheds light on how that pain is being felt unevenly. While low- and middle-income consumers are increasingly hesitant to spend on anything but the bare essentials, higher-income households continue splurging on luxury goods, travel, and tourism, further solidifying a K-shaped economy where inflation pain is concentrated at the bottom. That reality is reflected in public opinion: New Data for Progress polling shows more than 70% of voters are concerned about rising prices for groceries, health care, utilities, housing, and personal items, and a majority say corporate profits and executive compensation are driving higher costs.

Rather than taking action to ease financial pain for working Americans, Trump instead stepped up his unprecedented political interference with the Federal Reserve by launching a Justice Department probe into Fed Chair Jerome Powell. The administration’s continued attacks on the independence of the Fed have the potential to destabilize financial markets and further harm consumers already facing elevated prices and economic uncertainty.

This week in the Trump Slump, new polling and economic indicators continue to show that President Trump’s actions are deeply unpopular, hurting the economy, and harming America’s workers.

Polling and Economic Indicators on Trump’s Handling of the Economy:

- Grocery bills continue to climb thanks to Trump. American families paid $310 more on average for groceries during President Trump’s first year in office compared to 2024, according to a recent analysis by JEC.

- In a separate analysis by NPR which tracks the cost of 114 common items at Walmart every year, nearly half of tracked products became more expensive in 2025, with the total cost of the basket increasing about 5% over the past year. Items like shrimp, Oreo cookies, Coca-Cola, and Dove soap all saw price hikes, with notable increases on products from China and Vietnam due to Trump’s tariffs.

- Grocery prices increased 0.7% in December according to the latest CPI report, the largest one-month increase since October 2022, hitting family budgets hard over the holidays.

- Inflation remains stubbornly high. This week’s Consumer Price Index (CPI) report for December showed inflation at 2.7% year over year, still well above the Federal Reserve’s 2% target and likely artificially low due to the lingering effects of the government shutdown.

- Shelter and electricity drove December’s increase at 3.2% and 6.7% over the past year, respectively. Even video and video game subscription and rental services, which saw a 29% price increase over last year, aren’t immune to the price hikes.

- The delayed November Producer Price Index (PPI) report showed wholesale prices increased 3%, the highest level since last July and surpassing expectations of 2.7%. In November alone, wholesale goods prices rose 0.9%, the most since February 2024, driven primarily by energy costs. Since increases in producer prices tend to ripple through the supply chain, higher utility bills for consumers are likely ahead.

- The wealthy keep spending, while everyone else tightens their belts. In this week’s Federal Reserve Beige Book several Districts reported that spending was stronger among higher-income consumers with increased spending on luxury goods, travel and tourism while low to moderate income consumers were increasingly hesitant to spend on nonessentials. Similarly, this week Delta airlines posted a $5 billion profit even though revenue from economy tickets fell by $1.1 billion compared with 2024. Premium ticket sales more than made up the difference, offering another clear sign of a widening divide between economic “haves” and “have-nots.”

- Families want prices to come down. In a recent Politico poll, 53% of voters think that the cost of living being too high is the top issue facing the United States right now, followed by 30% who believe the state of the economy is the biggest issue, and 23% who believe health care is too hard to access.

- Similarly, more than 70% of voters were concerned about rising prices for groceries, health care, utilities, housing, and personal items, while corporate profits (77%) and compensation for executives (73%) are seen as driving costs most, according to Data for Progress.

- Despite Americans’ overwhelming concern with rising prices, only 36% of Americans believe Trump has the right priorities, down from 45% near the beginning of his term, according to a CNN poll.

- Americans know the economy is headed in the wrong direction. Two-thirds of Americans believe the cost of living has gotten worse in the past year, including 32% who believe it has gotten much worse, according to a recent Politico poll. Additionally, nearly half believe the cost of living here is the worst they can remember.

- Only four in ten Americans now say they expect the economy to be in good shape a year from now—down sharply from 56% just before Trump took office last January, according to a CNN poll. A majority, 55%, say Trump’s policies have made economic conditions worse, and nearly two-thirds, 64%, say he hasn’t done enough to bring down the cost of everyday goods.

Expert Commentary:

- “I described business conditions last year as driving through fog. It was hard to put your foot on the gas when you didn’t know what was around the next curve. It was hard to slam on the brakes lest it cause an accident. Most businesses spent the year on the side of the road with their hazards on; Not hiring but not firing; Not cutting back on investments but not leaning into more growth.” Tom Barkin President, Federal Reserve Bank of Richmond.

- “A retailer who is active in the Philadelphia area told us they are seeing lots of headwinds for the consumer, especially for lower-income individuals. Even individuals with discretionary income to spend are being careful. For example, although people are still eating out in Philadelphia, contacts tell us that less expensive options on the menu are becoming more popular. The only exception to this trend is at more upscale restaurants. High-income households, bolstered by a strong stock market, appear to be driving elevated consumption growth”. –Anna Paulson, President and CEO, Federal Reserve Bank of Philadelphia.

- “Anything that’s infringing or attacking the independence of the central bank is a mess”[…] You’re going to get inflation come roaring back if you try to take away the independence of the central bank.” –Austan Goolsbee, Chicago Federal Reserve President.

- “Nevertheless, several contacts described a bifurcated, or K-shaped, economy this holiday season. Specifically, discretionary spending by high-income households continued at robust levels, with brisk demand for luxury products, while low- and middle-income households continued to trim budgets and trade down to lower-cost and store-label alternatives.” –Federal Reserve Beige Book.